Created from Youtube video: https://www.youtube.com/watch?v=eIvsMiXQDLQvideo

Created from Youtube video: https://www.youtube.com/watch?v=eIvsMiXQDLQvideoConcepts covered:candlestick wicks, multi-timeframe analysis, trend direction, support and resistance, trading decisions

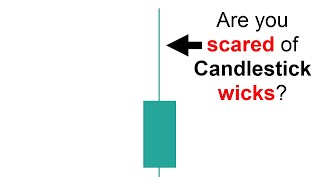

The video provides insights into understanding candlestick wicks in trading, emphasizing the importance of context and multi-timeframe analysis to avoid premature trade exits or entries. It highlights that wicks are not inherently bearish or bullish signals but should be analyzed in conjunction with trend direction, support and resistance levels, and lower timeframe structures for better trading decisions.

chapter

1

Master Candlestick wicks! all Trading Secrets revealed

Concepts covered:candlestick wicks, multi-timeframe analysis, trend direction, support and resistance, trading decisions

The video provides insights into understanding candlestick wicks in trading, emphasizing the importance of context and multi-timeframe analysis to avoid premature trade exits or entries. It highlights that wicks are not inherently bearish or bullish signals but should be analyzed in conjunction with trend direction, support and resistance levels, and lower timeframe structures for better trading decisions.

Question 1

Candlestick wicks always indicate a market reversal.

Question 2

How should traders interpret a pin bar?

Question 3

Using a 50 SMA helps distinguish between _____ and bearish markets.

Question 4

CASE STUDY: A trader sees a pin bar at a support level.

What does this scenario mean?

Question 5

CASE STUDY: A trader evaluates a candlestick wick at a resistance level.

Select three correct actions to consider.

Question 6

A single candlestick is insufficient for comprehensive market analysis.

Question 7

What is the role of support and resistance levels?

Question 8

A pin bar on a higher time frame may not indicate a _____ signal.

Question 9

CASE STUDY: A trader notices a large candlestick wick during a strong uptrend.

What should the trader do next?

Question 10

Market trends move in a straight line without fluctuations.

Question 11

What does a candlestick wick indicate in trading?

Question 12

The market's path of least resistance is often determined by _____ levels.

Question 13

Wicks on higher time frames are always bearish signals.

Question 14

What is crucial for effective candlestick analysis?

Question 15

A single wick is insufficient for making _____ decisions.

Question 16

A pin bar always suggests a bullish market.

Question 17

How can moving averages assist in trading decisions?

Question 18

A candlestick wick can indicate a _____ pattern on a micro level.

Would you like to create and run this quiz?

yesCreated with Kwizie